There’s always some new twist waiting to trip up a traveler. Sometimes it’s a flight delay, sometimes it’s the wrong bus, and sometimes – believe it or not, it’s the tax on your bed for the night. Yes, the GST rate on hotel room bookings has been in the spotlight again, and anyone planning a trip across India this year might want to keep an eye on it. After all, scoring the best flight deals online is only half the story, what you pay once you land and check into a hotel is the other half.

And here’s the thing – hotels in India are wildly diverse. From budget stays near railway stations smelling faintly of hot samosas and diesel fumes, to luxury seaside resorts where the sheets feel smoother than a mango lassi, it all adds up. With the new GST rate on hotel room rent kicking in, even the most seasoned backpackers are squinting at bills and wondering what exactly changed.

TABLE OF CONTENTS

The Shift: What the New GST Rates Actually Mean

Image Credit: AI Generate

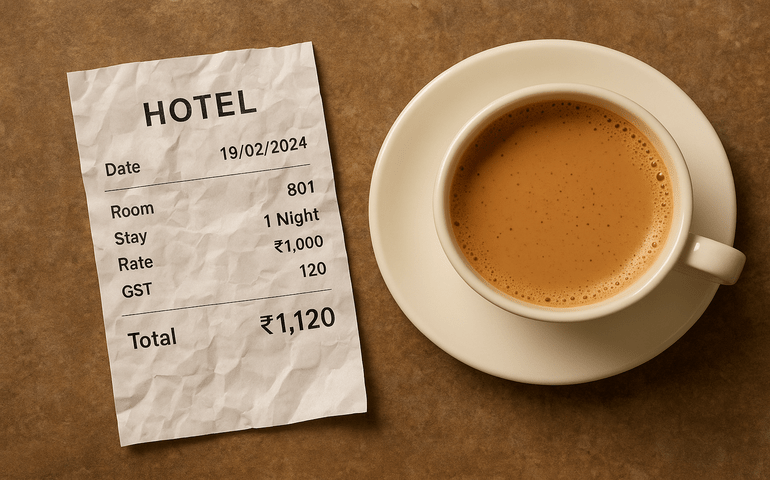

So, here’s the chatter over chai stalls: the New GST Rates on Hotel Rooms 2025 bring some tweaks to how hotels are taxed depending on the tariff bracket. Until recently, anything under ₹1,000 a night wasn’t taxed. Handy for backpackers chasing budget digs. But now, the GST rate on hotel room rent below 1,000 is set to shake things up because those rooms no longer slip under the radar.

It’s the kind of detail travelers usually find out the hard way, right at check-out, when a cheerful receptionist says, “Sir/Madam, plus GST.” That extra 12% or 18% can feel like a surprise cab ride across town; unexpected, mildly annoying, but inevitable.

Luxury stays obviously feel it too. Just imagine, you’re booking a ₹7,500 resort in Goa, sipping coconut water by the pool, and then remembering that the GST Cut on Hotel Rooms didn’t exactly happen & rates are still significant. Some say the adjustment might make travelers rethink whether they go luxe or stick to budget. Either way, it’s all part of the travel puzzle.

Also Read About 12 Hotel Safety Tips No One Talks About – But Could Save Your Life

Beyond Rooms: The Food Factor

Image Credit: Vikash Mithal/Shutterstock

And don’t even get started on dinner bills. Travelers swapping stories on night trains will tell you how GST on hotel food can be a bigger shocker than the price of the room. A paneer butter masala that’s already ₹400 ends up heavier when tax is stacked on top. But then again, the joy of scooping up buttery naan while monsoon rain drums outside usually cancels out the grumble. Usually.

For the Curious Minds

For anyone into the detail-nerdy side, there’s this thing that every hotel service gets slotted into a code. The hotel room rent HSN code and GST rate is what decides how much tax sits on your final receipt. Sounds technical, and it is, but it’s also the kind of thing that makes travel bloggers chuckle. Who knew your two nights in Jaipur came with a mini economics lesson?

How This Feels on the Ground

Taxes aren’t usually what people dream about when planning holidays. But in India, where hotels can be as cheap as ₹600 or as fancy as ₹60,000 a night, the GST rate on hotel room stays can genuinely shape the mood of a trip.

Picture this: a sweaty backpacker stumbling off a 14-hour train from Delhi to Varanasi. All they want is a fan that works, a bucket of cold water, and maybe Wi-Fi if the gods are kind. That ₹950 room used to be tax-free. Now it’s nudging past ₹1,000, thanks to GST. Not exactly deal-breaking, but enough to make a traveler laugh and mutter, “Even my dal tadka’s cheaper than this tax.”

Practical Travel Bits

- Flights: If the plan is to travel across India, it’s smart to stalk the best flight deals online. Grab early deals to soften the GST blow later.

- Hotels: Budget stays can still be found, but that sweet spot below ₹1,000 now carries a sting. For mid-range rooms, expect ₹2,500–₹4,000 plus tax. Luxury? Sky’s the limit. Always cross-check the best deals on hotel bookings online.

- Visas: For international travelers, online visa services for 180+ countries keep the process smooth.

- Money: With GST layers adding up, it helps to manage travel money smartly. ATMs are everywhere, but forex cards save a lot of “oops” moments.

- Tours: Those who hate surprise expenses sometimes lean into all-inclusive tour packages. At least the bills are upfront.

Also Read: Tech Advice for Simple Planning: Power of a Hotel Booking App

Quick Travel Tips

- Always check if the rate quoted is “inclusive of GST” or not just tiny words. It’s make a big difference.

- Carry a little extra cash for food since GST on hotel food can balloon bills faster than expected.

- Mid-week stays often dodge the worst surges; weekend weddings and conferences can double room costs.

- Don’t stress the math too much. Think of it like bargaining with an autorickshaw driver and sometimes you win, sometimes the meter does.

- If traveling on a strict budget, hostels and dharamshalas (pilgrim stays) often remain unaffected by hotel-style taxes.

Closing Thoughts

At the end of the day, taxes are just another travel quirk like the stubborn rooster crowing outside a Goa hostel at 4 a.m. or the train that’s “on time” only by Indian Railways standards. Sure, the GST rate on hotel room bookings can tilt a budget, and the new GST rate on hotel room rent has stirred plenty of chai-fueled debates. But travelers adjust. They always do.

FAQs – New GST Rate on Hotel Room

Is there GST on hotel rooms in 2025?

Yes, GST is applicable on hotel rooms in 2025. The rate depends on the room tariff, ensuring that budget stays are taxed lower while premium and luxury stays fall under higher GST slabs.

What is the new GST rule for hotel rooms?

The new GST rule for hotel rooms follows a slab-based system, where the tax percentage is linked to the nightly tariff. This means travelers pay a fairer tax rate based on whether they choose budget, mid-range, or luxury accommodation.

Is there GST on hotel rooms above 7500?

Yes, hotel rooms priced above ₹7,500 per night attract the highest GST slab of 18%. This rule mostly impacts premium and luxury properties, making it important for travelers to factor GST into their total stay cost.

Is there GST on hotel rooms under 1000?

No, hotel rooms with tariffs below ₹1,000 per night are fully exempt from GST. This exemption helps budget travelers and backpackers save money while booking affordable stays.

Is there GST on 5-star hotels?

Yes, 5-star hotels are also covered under the GST framework. Since their tariffs generally exceed ₹7,500 per night, they usually fall into the 18% GST slab, making them more expensive compared to mid-range or budget stays.

You May Also Like:

High-Tech Hotel Amenities and Smart Room Technology in Hotels

Pets Onboard: Rules and Charges for Flying with Your Furry Friend

Airlines That Offer Wi-Fi Onboard: Stay Connected in the Clouds

Akbar Travels Services

Best Flight Deals

Mumbai to Delhi Flight Tickets | Mumbai to Bangalore Flight Tickets | Kolkata to Mumbai Flight Tickets | Kochi to Abu Dhabi Flight Tickets | Lucknow to Riyadh Flight Tickets | Delhi to Ahmedabad Flight Tickets

Domestic Flights

Pune to Bangalore Flights | Chennai to Delhi Flights | Bangalore to Chennai Flights | Mumbai to Delhi Flights | Bangalore to Hyderabad Flights | Ahmedabad to Goa Flights | Mumbai to Kolkata Flights | Hyderabad to Delhi Flights | Bangalore to Goa Flights | Mumbai to Goa Flights

International Flights

International Flights Booking | Delhi to Dubai Flights | Delhi to Bangkok Flights | Delhi to Toronto Flights | Mumbai to Dubai Flights | Delhi to Singapore Flights | Delhi to London Flights | Delhi to Kathmandu Flights | Mumbai to London Flights | Chennai to Singapore Flights | Mumbai to Singapore Flights | Delhi to New York Flights | Kolkata to Bangkok Flights

Best Hotel Deals

Hotels In Dubai | Hotels In Mumbai India | Hotels In Pune India | Hotels In Singapore | Hotels In Kochi India | Hotels In Munnar India | Hotels In Bangkok Thailand | Hotels In Kuala Lumpur Malaysia | Hotels In Mecca Saudi Arabia | Hotels In Mahabalipuram India

Apply Visa Online

Dubai Visa Online | 14 days Dubai Visa | 30 days Dubai Visa | 60 days Dubai Visa | Dubai Transit Visa | UAE Visa | Singapore Visa | Malaysia Visa | Thailand Visa | Sri Lanka Visa | US Visa | UK Visa | Schengen Visa | Canada Visa | Australia Visa | New Zealand Visa | France Visa | Italy Visa | Turkey Visa Online | Philippines Visa | Cambodia Visa Online | Vietnam Visa Online | Oman Visa

International Tour Packages

Dubai Tour Packages | Singapore Tour Packages | Thailand Tour Packages | Malaysia Tour Packages | Sri Lanka Tour Packages | US Tour Packages | United Kingdom Tour Packages | South Africa Tour Packages | Europe Tour Packages | Bali Tour Packages | Mauritius Tour Packages | Maldives Tour Packages | Cordelia Cruise Packages |

Domestic Tour Packages

India Tour Packages | Goa Tour Packages | Kerala Tour Packages | Leh Ladakh Tour Packages | Himachal Tour Packages | Andaman Tour Packages | Rajasthan Tour Packages | Uttarakhand Tour Packages | Jammu and Kashmir Tour Packages

Packages by Themes

Honeymoon Packages | Adventure Packages | Visa on Arrival Packages | Family Packages | Romantic Packages | Weekend Getaways Packages

Pingback: Check Into Grandeur: Iconic Luxury Hotels in Abu Dhabi Await

Pingback: Places to Visit in the United Kingdom That’ll Break Instagram

Pingback: GST Rates in India: Costs Affecting Your Travel Budget NOW!

Pingback: 6 Best Hotels in Kolkata for Every Kind of Traveler

Pingback: Ever Wondered Which Is the Safest Hotel Floor? Here’s the Answer